AI

AI

AI

AI

AI

AI

Predictions about enterprise tech have never been more uncertain. They become even more challenging when you try to make forecasts that are measurable. Generally, our belief is we should be able to look back a year later and say with some degree of certainty whether the prediction came true – ideally with some quantifiable evidence to back that up.

In this Breaking Analysis and for the third year in a row, we collaborate with Erik Bradley of Enterprise Technology Research and to share our annual enterprise technology predictions.

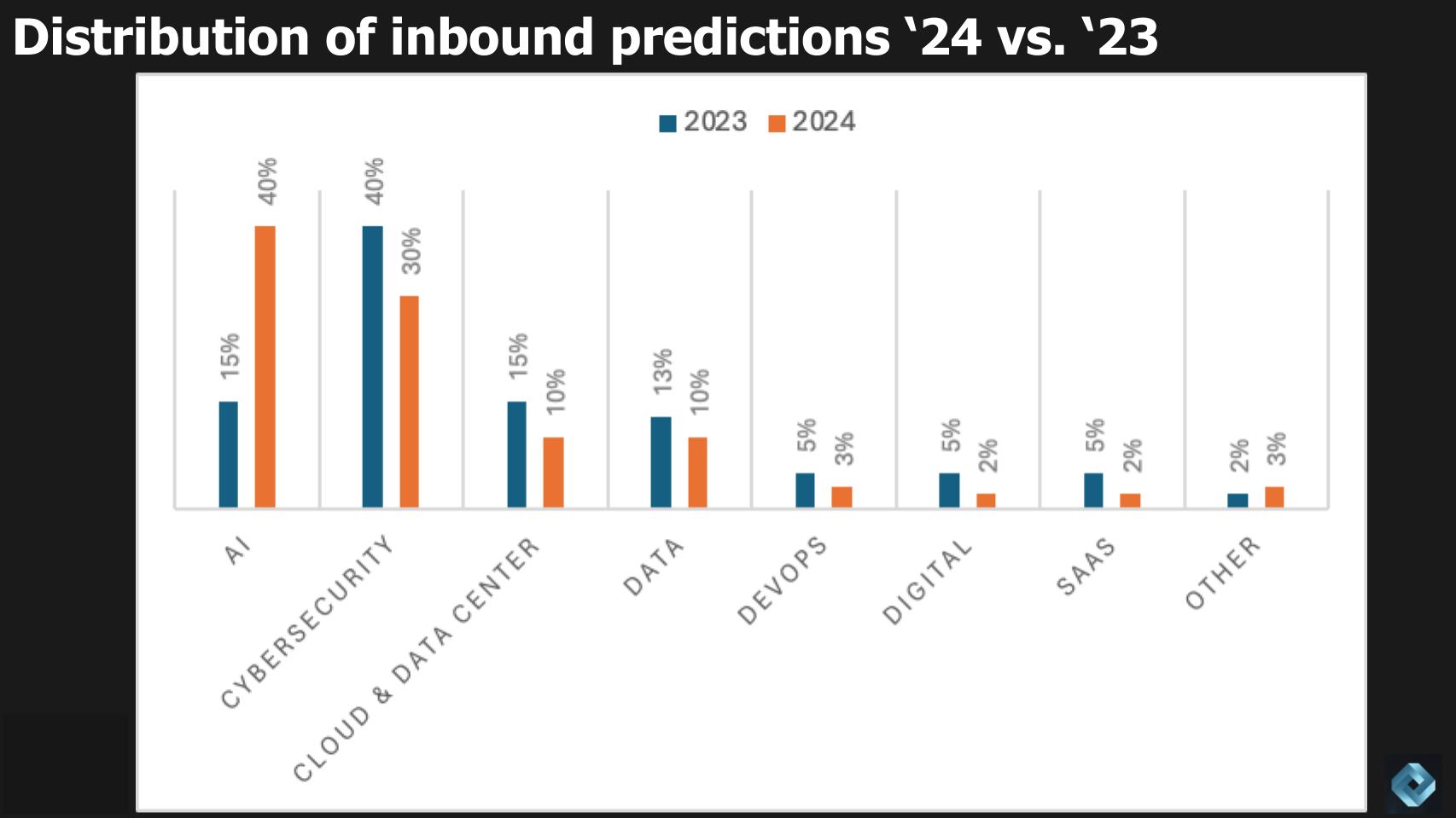

Since we started this tradition, public relations folks have kindly provided their clients’ perspectives on the trends to watch in the coming year. The graphic above shows the change in the lead categorical topics from these outreaches relative to last year.

It’s no surprise to see a huge jump in artificial intelligence predictions, which are partially understated because virtually all these categories included some AI content. Cybersecurity is down but still prominent followed by cloud, data center and data/analytics. Then a smattering of DevOps, digital, software as a service and some other tidbits.

Here are two other resources you may be interested in reviewing:

Below is a quick scan and rundown of this year’s predictions where we cover the macro information technology spending environment, the state of generative AI, AI return on investment, cybersecurity, mergers and acquisitions, data quality, governance, skills, momentum for legacy players, and 2024 technology priorities.

OK, let’s get started.

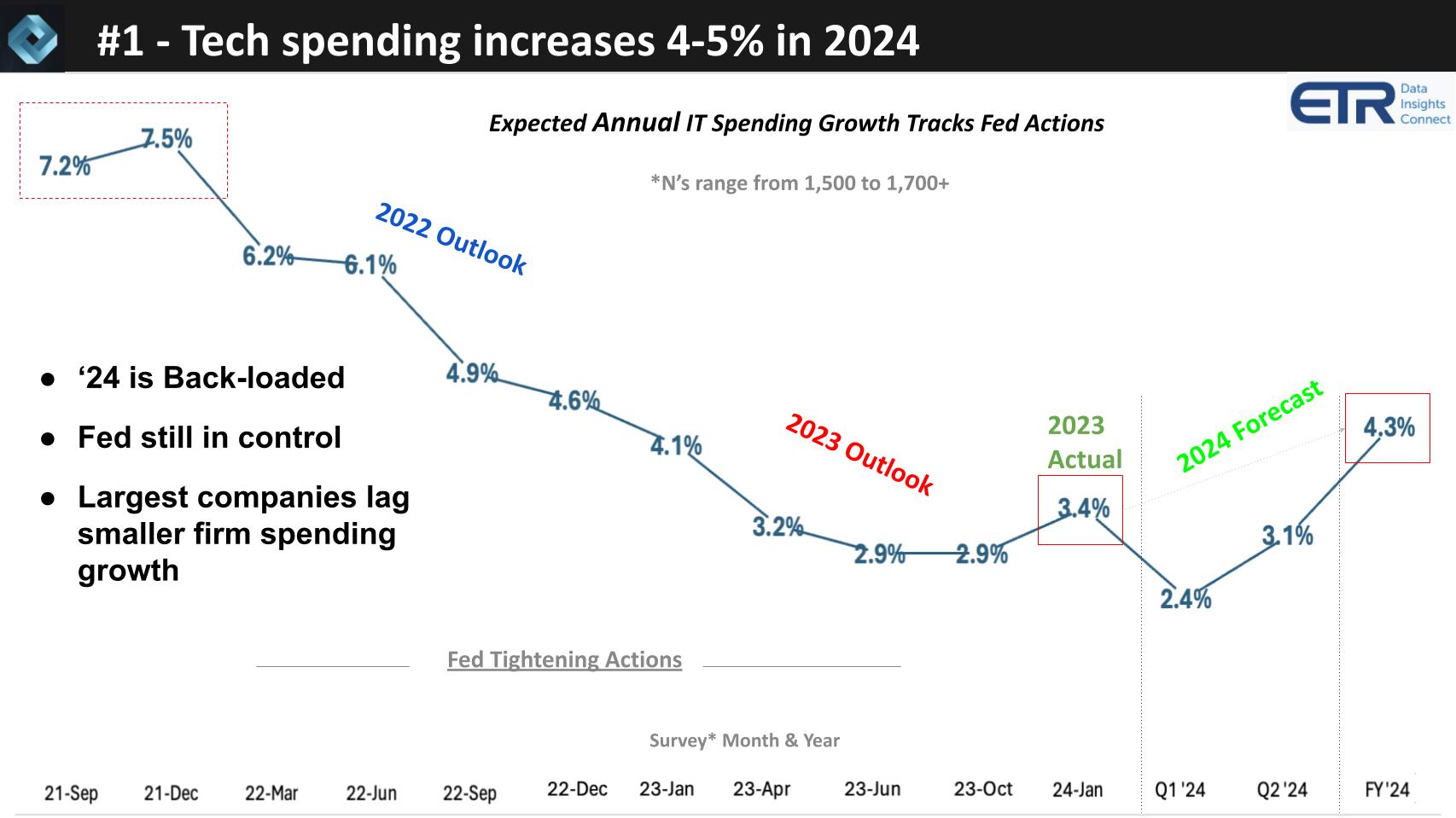

The graphic below shows the annual tech spending growth expectations from more than 1,500 IT decision makers, or ITDMs, at different points in time.

ITDMs exited the isolation economy very enthusiastic, with execs expecting their tech budgets were going to increase 7.5%. We know what happened. Ukraine, Fed tightening and all through 2022, we saw those expectations for the year go down. After the Fed stopped tightening, we saw a flattening out of expected annual growth at 2.9%.

ITDMs on average said that in 2023, their spending ended up growing at 3.4%. You can see the forecast for 2024 is 4.3%, but it’s back-loaded with Q1 and Q2 2024 expected to grow at 2.4% and 3.1%, respectively.

The following additional points summarize our research and predictions. Our analysis indicates a cautiously optimistic outlook for spending trends in the IT sector. Key observations from this discussion are as follows:

In summary, our opinion on the macro is that these developments, particularly the increased engagement of large organizations in spending and the positive signs in the IT sector, paint a cautiously optimistic picture for the continuation of this spending trend throughout the year. However, the ongoing caution due to macroeconomic uncertainties, the backloaded nature of the forecasts and the significant role of the Federal Reserve’s policies cannot be overlooked.

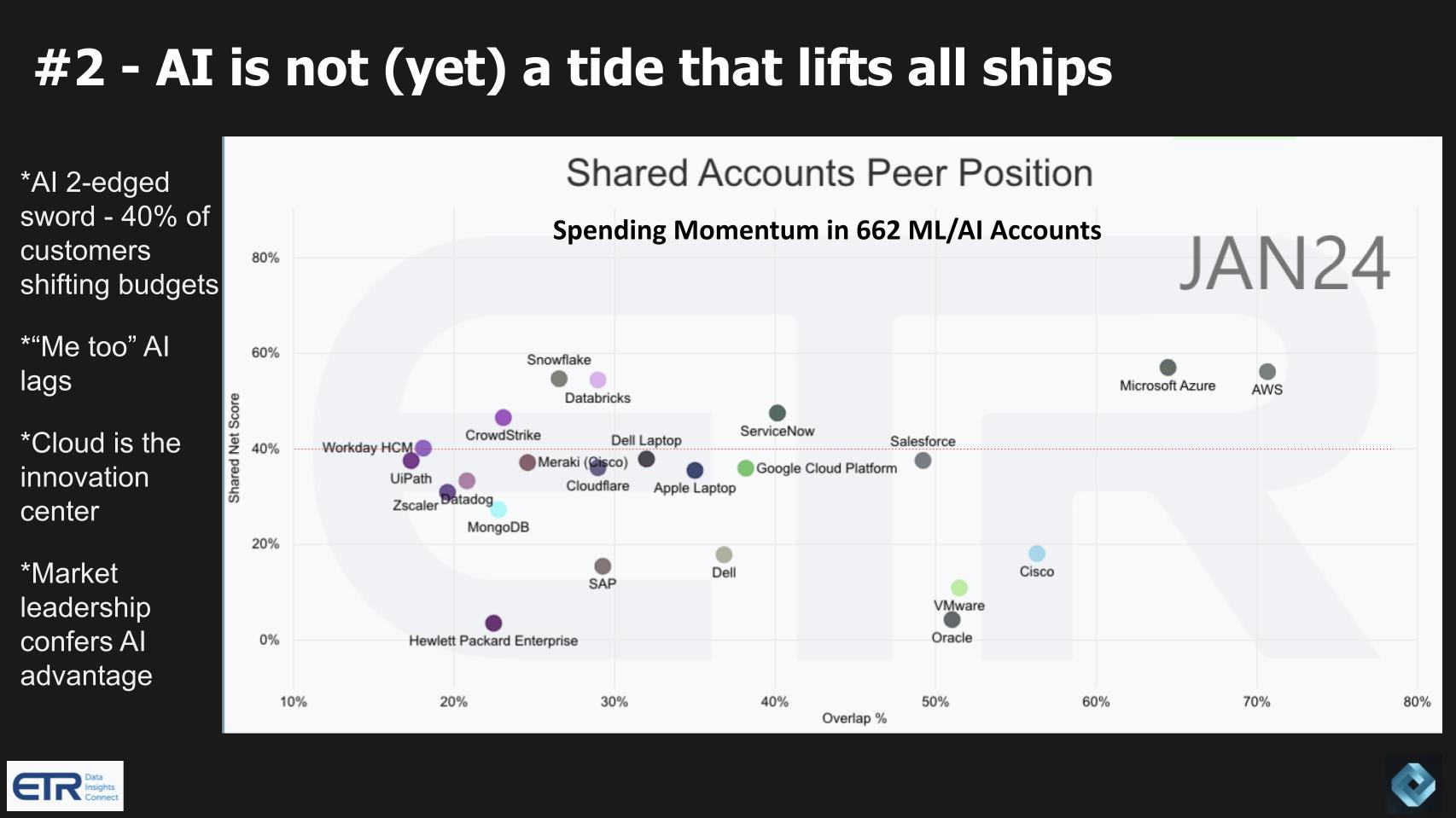

The graphic below shows data that measures spending momentum or Net Score on the vertical axis and the presence of a company or platform within the survey set of more than 1,700 respondents on the horizontal axis. This cut isolates those 1,700 down to 662 machine learning/AI accounts. So it’s a measure of the prominence of various companies, platforms and products within those 662 ML/AI-heavy accounts. The red line at 40% indicates a highly elevated spending velocity.

There’s a popular narrative that AI is benefiting everybody. We don’t think this is the case and we believe it will become more evident in 2024. Specifically we see a market of AI haves and have-nots.

AI in our view is a two-edged sword. In some cases it can be a tailwind. Pure-play AI companies such as OpenAI, Anthropic PBC, Hugging Face Inc. and some others are obviously benefitting from the trend. Notably, the public cloud vendors and even the specialized AI clouds such as CoreWeave Inc., Core42, Lambda Inc. and Genesis Cloud GmbH are certainly benefitting from the elevation in mindshare. However, 40% of customers say that their AI funds are coming from other budgets.

Our prediction is that in 2024 we’ll see a divergence between those companies delivering meaningful AI value and those delivering “me-too AI” will lag. In the January data above, you can see the platforms that have AI affinity. Microsoft Corp. with Azure has its OpenAI partnership. Amazon Web Services Inc. is prominent as well. They’re both above that 40% line. Notably, Google LLC is far below those two despite its AI investments and capabilities.

ServiceNow Inc.’s recent quarterly results indicate AI is a tailwind. Databricks Inc. and Snowflake Inc. have high AI alignment, as do CrowdStrike Holdings Inc. and Zscaler Inc. Salesforce Inc. is pounding its AI messaging in television and digital ads, and Workday Inc. is building AI into its SaaS products, as is Oracle Corp.

Interestingly we also see laptops from Dell Technologies Inc. and Apple Inc. as prominent. Apple has for years shipped products with diverse silicon from its Arm-based internal development efforts, including not only central processing unit but graphics processing unit and neural processing unit capabilities.

Others such as MongoDB Inc. are adding vector embeddings, which have been well accepted and support the creation of retrieval-augmented generation or RAG capabilities. Others such as Cisco Systems Inc., which is not seen as an obvious AI company, are benefitting from acquisitions such as Meraki. Hewlett Packard Enterprise Co.’s acquisition of Juniper Networks Inc. was in large part about bolstering its AI capabilities.

Although companies are making moves, not all will be successful in terms of generating revenue and shareholder value and we predict that will become more obvious in 2024 with a bifurcated market.

Me-too AI vendors will sink – Mike Finley, CTO of AnswerRocket

The following additional points summarize our research and predictions:

In summary, our view is that the technology sector is experiencing a transformative phase, with hyperscalers and sophisticated data companies leading the way in AI applications. The RPA sector, in particular, presents an intriguing area of development, where the integration of gen AI could redefine market dynamics. The success of companies in this evolving landscape appears to hinge on their ability to genuinely embed and execute AI strategies, rather than merely market superficial applications.

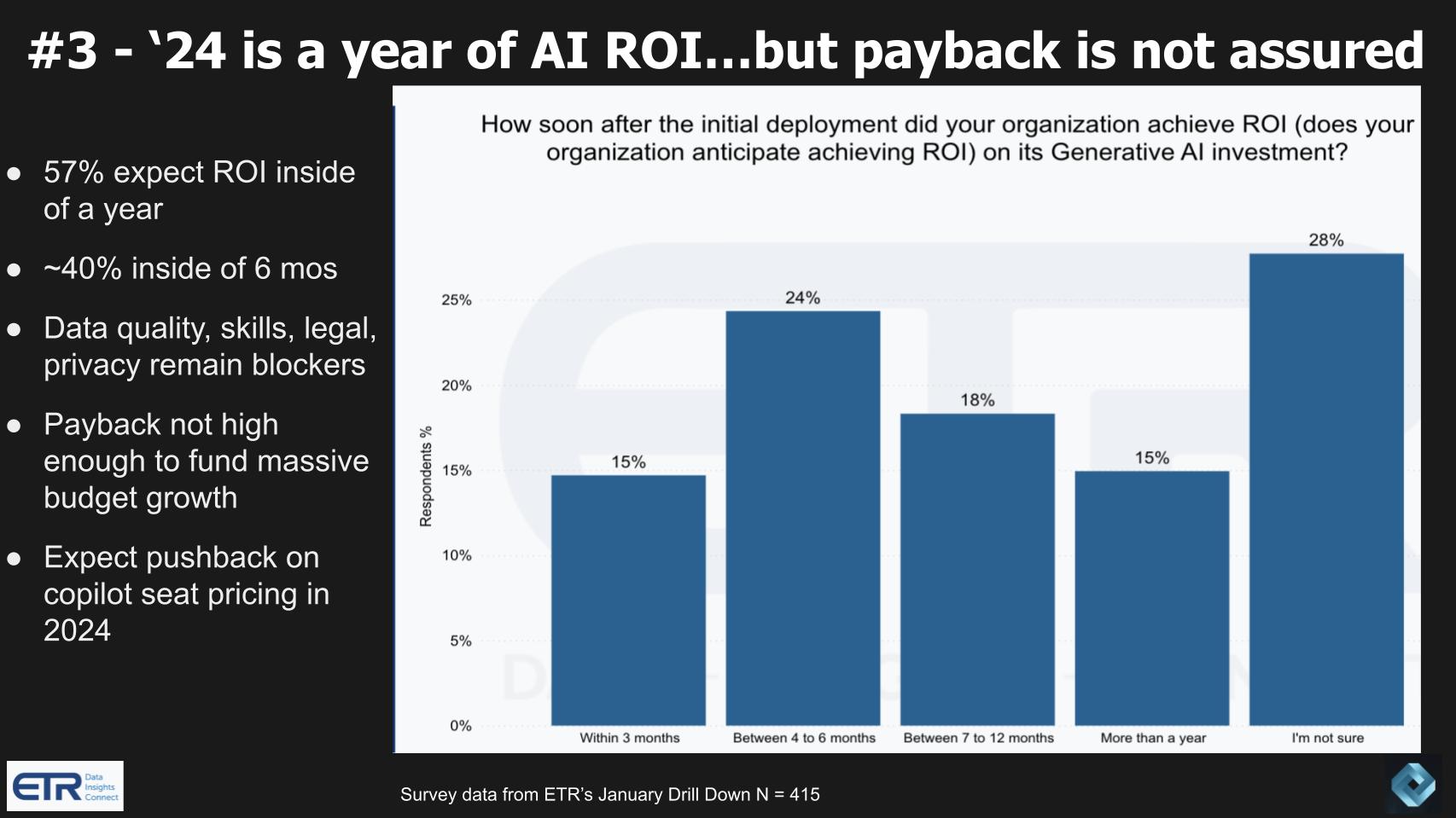

The graphic below is from an ETR drill-down survey exploring the ROI of AI. It is not precise in that it allows the respondent to interpret the question as either breakeven (time to positive value) or hitting ROI targets.

Our analysis covers several key points:

In summary, our analysis suggests that while there is a high expectation of achieving ROI from gen AI within a short period, there are also significant challenges and concerns, particularly regarding budget allocation and pricing models. The reallocation of funds from other areas, including RPA budgets, indicates a strategic shift toward gen AI. However, the ultimate success and acceptance of gen AI in the market will depend on its ability to deliver tangible benefits and justify its implementation costs.

The bottom line on this prediction is there are two possible outcomes we’re predicting: 1) AI ROI is evident and fuels an increase in overall tech spending; or 2) AI fails to deliver on its expectations for 2024 and tech spending remains tepid. Our base case is AI ROI will not throw off enough free cash flow in 2024 to provide “gainshare” funding that increases overall IT spending beyond the expected average.

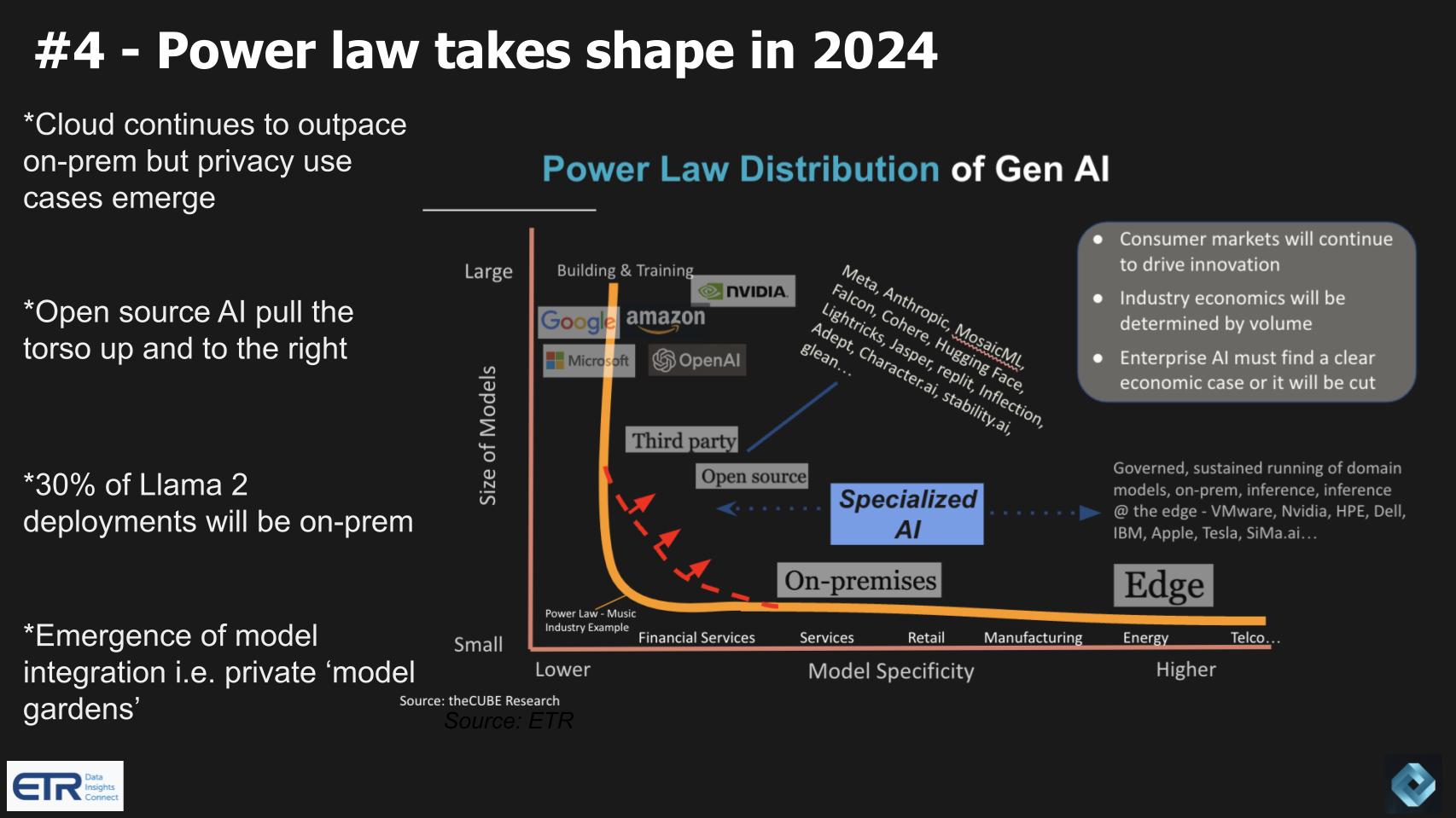

The gen AI power law developed last year by theCUBE Research team attempts to articulate how we see generative AI and large language models evolving. Unlike some industries — for example, the music industry of yesterday, where a few dominant players ‘own’ the market and there’s a long tail of super-small players — we see gen AI as somewhat different.

Although the hyperscalers are dominating the market for large models (size of model on the vertical axis), we see an emerging market for specialized models with domain knowledge that are smaller (horizontal axis). The long tail is similar, but the torso is pulled up and to the right by open source and independent company models.

Additional key points in this prediction include:

In summary, our analysis suggests that while the cloud giants currently dominate the Gen AI space, there’s a significant desire from many public companies towards on-premise and private cloud deployments due to data privacy and regulatory concerns. We predict in 2024, the industry will see the early stages of the power law taking shape, with a long tail of specialized AI and a growing emphasis on data sovereignty. This trend is expected to become more pronounced over time underscoring a diverse and evolving Gen AI landscape.

Here are some inbound 2024 predictions from the community related to this topic:

The gen AI dialogue is going to move from theory to practice and is going to focus more on inference – John Roese, CTO of Dell Technologies

Specialized AI will take shape and open source models will emerge – Quentin Clark, General Catalyst

Hypermodal AI, which combines different AIs with other data sources will emerge – Bernd Greifeneder, CTO, Dynatrace

Gen AI has to be viewed as a feature of industry solutions, not a solution in and of itself – Bryan Harris, CTO, SAS Institute

We’re headed more toward a gen AI monopoly – Patrick McFadin, DataStax

We agree that these domain-specific AIs are going to see a long tail begin to emerge in 2024. Regarding Patrick McFadin’s prediction, we hope not. We agree that hyperscalers right now are in the leaders with the need to build and perfect large models. This has to happen before higher-quality, high-volume inference begins to dominate. But if he’s correct, this prediction will fail in the long term.

Of note, McFadin predicted back in November that regulators are going to come raining down on these big cloud companies. That prediction has already come true with FTC Chair Lina Khan’s actions this week.

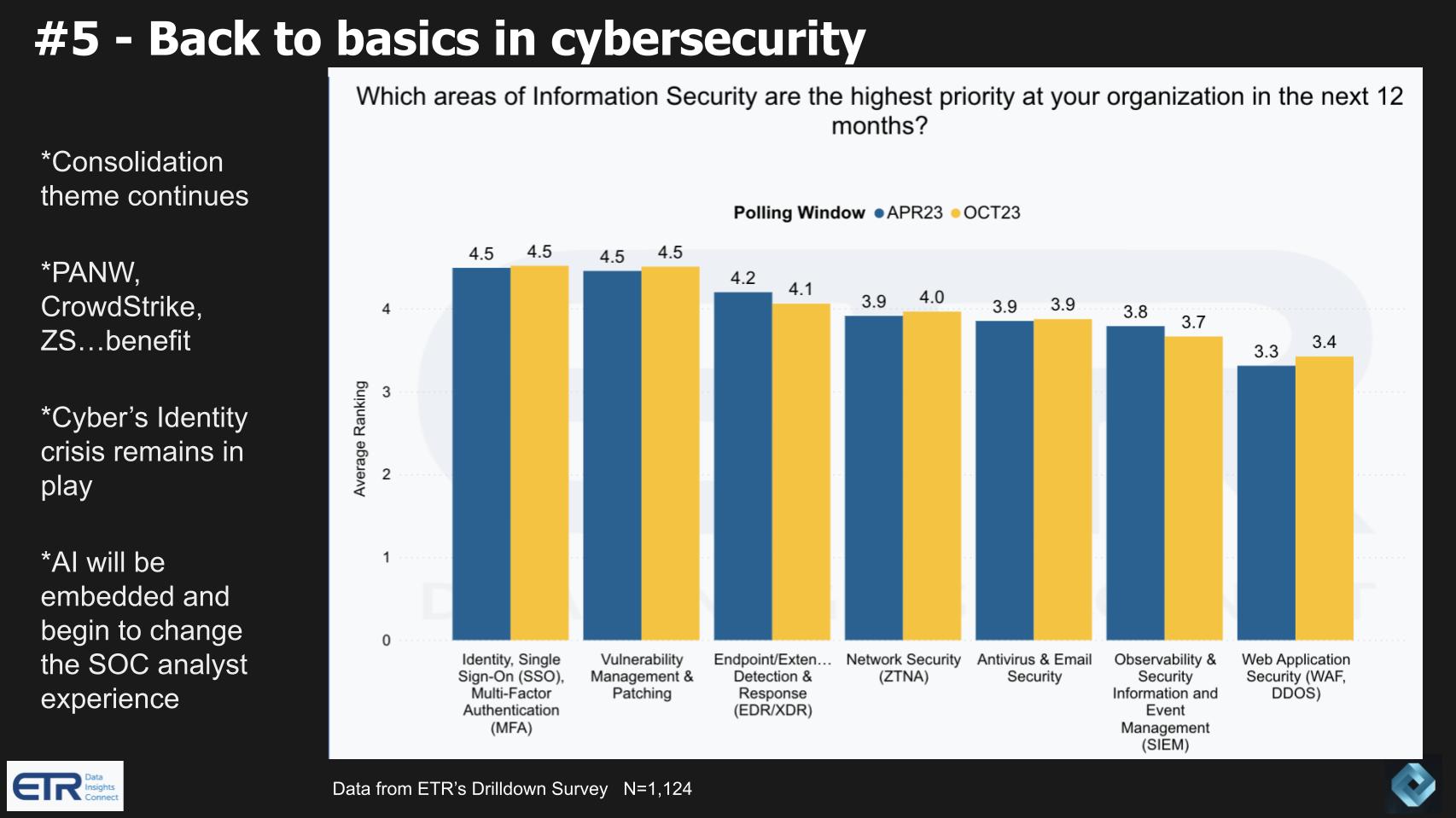

The chart below drills into ITDMs’ security priorities in the coming year.

Our analysis of this data and predictions call for a notable shift towards fundamental security measures, coupled with the continued evolution and integration of AI technologies. Key points from our research supporting our predictions are as follows:

In summary, our prediction for the cybersecurity sector in the coming year is a dual emphasis on foundational security practices and the strategic integration of AI. This approach, along with continued market consolidation and openness to innovation from startups, signals a dynamic and evolving landscape in cybersecurity that will remain problematic. Leading practitioners will take a back-to-basics approach as the most effective means of stopping breaches.

Here are some inbound 2024 predictions from the community related to this topic:

65% of organizations are not confident that their, not very confident their organizations could fully recover from a data loss incident –Dell Technologies Global Data Protection Index

52% of production data is backed up on tape still. So everybody says tape is dead, no, it’s not. And 61% of production data is also backed up in the cloud – Veeam’s Data Protection Trend Report

Voice is going to become the new fingerprint – Aron England, chief product officer and CTO of Rev

Overhyped tools drive the need for security operations – Nick Schneider, CEO, Arctic Wolf

In cybersecurity, 2023 saw 437 funding rounds and M&A transactions with $8.6 billion raised over 346 rounds and 91 total acquisitions last year – Mark Sasson, Pinpoint Search Group

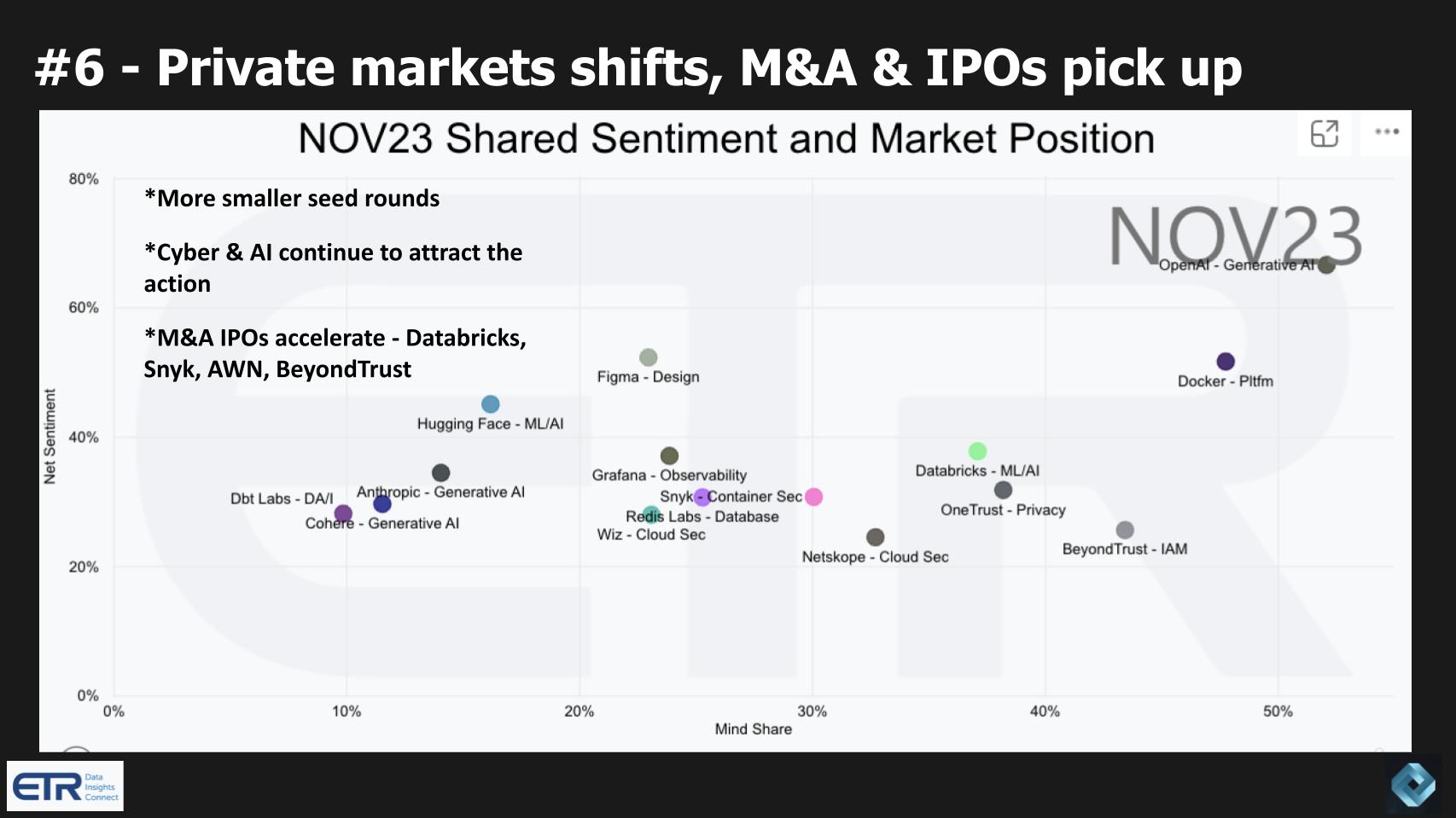

Our analysis of the private market M&A and initial public offerings in the technology sector reveals several key trends and predictions:

In conclusion, our prediction is that the technology sector, particularly in AI and cybersecurity, will experience a resurgence in M&A and IPO activities to levels above those seen last year but less than half of those from 2021. This trend is underpinned by the tech sector’s improving performance, strong balance sheets, AI imperative and the high potential of emerging technologies. The increase in smaller seed funding rounds also indicates a vibrant and evolving startup ecosystem, particularly in the AI and cybersecurity domains.

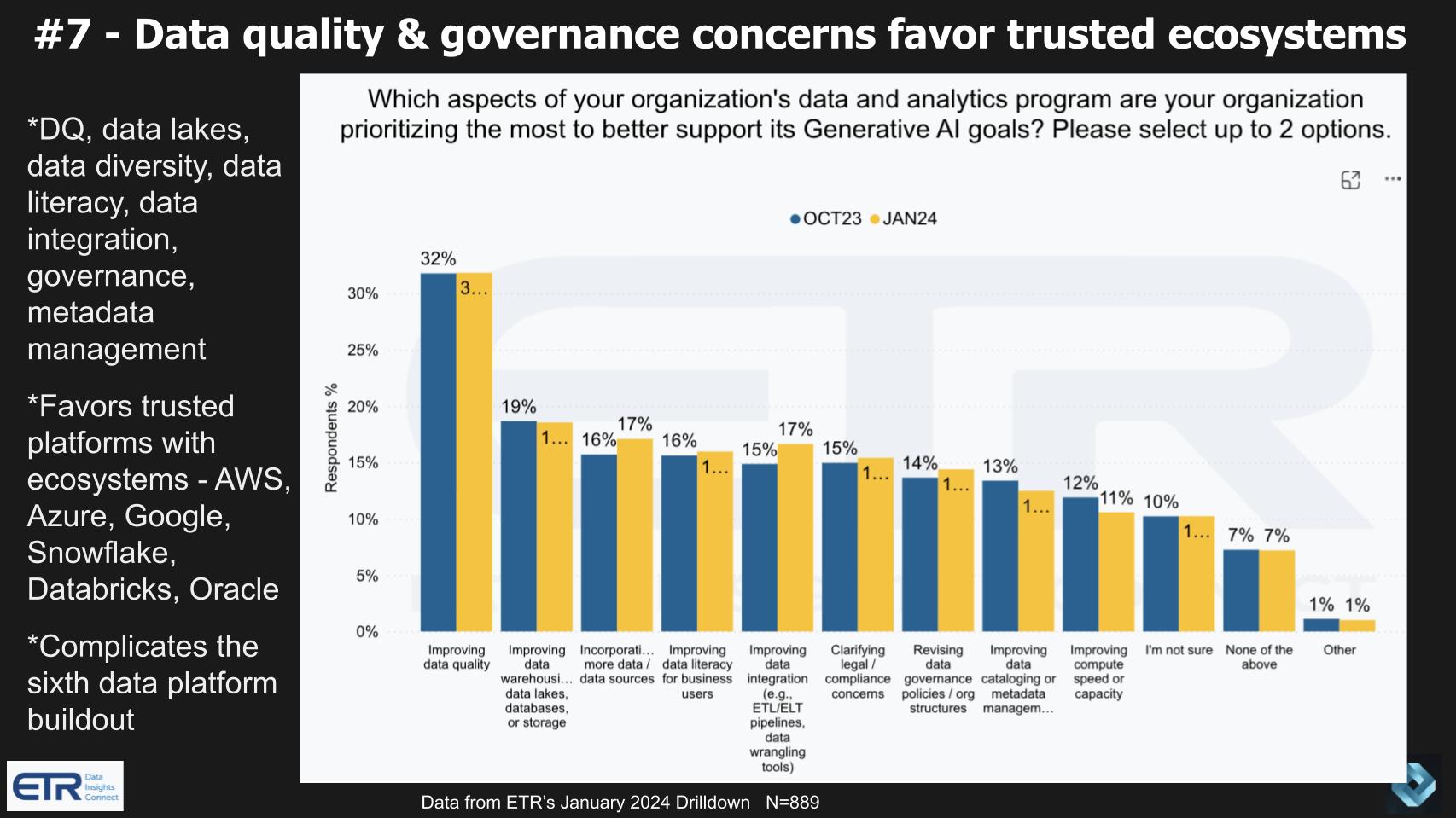

Our analysis predicts a significant shift toward prioritizing data quality and governance, which in turn favors established and trusted technology ecosystems. This shift is driven by the need to support Gen AI goals effectively. Key data points from an ETR drill-down survey are shown in the graphic below and highlight the data challenges faced by practitioners.

Relevant points on this prediction include:

In summary, for 2024 our prediction is that the demand for high data quality and robust governance will increasingly favor established technology platforms with comprehensive ecosystems. These platforms are likely to become even more pivotal in supporting organizations’ gen AI initiatives due to their advanced capabilities in handling complex data types and ensuring data integrity.

Followers of Breaking Analysis have seen our work on the sixth data platform. Although we believe the future of data platforms will shift emphasis to real-time, unified data sources, the challenges cited above, especially related to governance, will push its emergence to the second half of this decade.

Our analysis highlights the growing importance of new data literacy and skills in the continued application of gen AI and business-user-friendly technologies like low-code/no-code applications, RPA and generative UI tools. The survey results and our key points below underscore the data challenges organizations face in achieving their gen AI goals.

Note: ETR’s Daren Brabham provided this prediction.

Gen AI – as well as more business-user-friendly self-service capabilities like low-code/no-code, RPA and “gen UI tools” (code generated from screen grabs) – brings with it new sets of skills that will be in demand in the market. Watch for a rise in offerings from IT training companies such as Pluralsight, Skillsoft,LinkedIn Learning, Coursera and others that focus on things like gen AI prompt management” or “ethical/responsible use of gen AI.” We’ll start to see new roles such as “gen AI prompt engineer” in the market. As more orgs let gen AI proliferate, there will need to be more data literacy training in general across the workforce so that the outputs from gen AI are used properly and gen AI “hallucinations” are seen with a critical eye… or minimized.

In conclusion, our prediction is that the demand for new data literacy and skills related to gen AI and associated technologies will continue to grow. This trend will likely lead to an expansion of educational offerings, the emergence of new job roles, and a greater emphasis on data literacy across all levels of the workforce. As AI becomes more embedded in business processes, staying abreast of these evolving skillsets will be crucial for professionals across various industries.

Yes Code: Generative AI + Frontend = Generative UI. [In 2024], we’ll see more “generative UI” tools that enable instant creation of UI code from screenshots, drawing, voice, or prompts. Critically, the tools that embrace established industry tools (like React) for their outputs, will lower the barrier for shipping generated code in real product use cases – Lee Robinson, vie president of product, Vercel

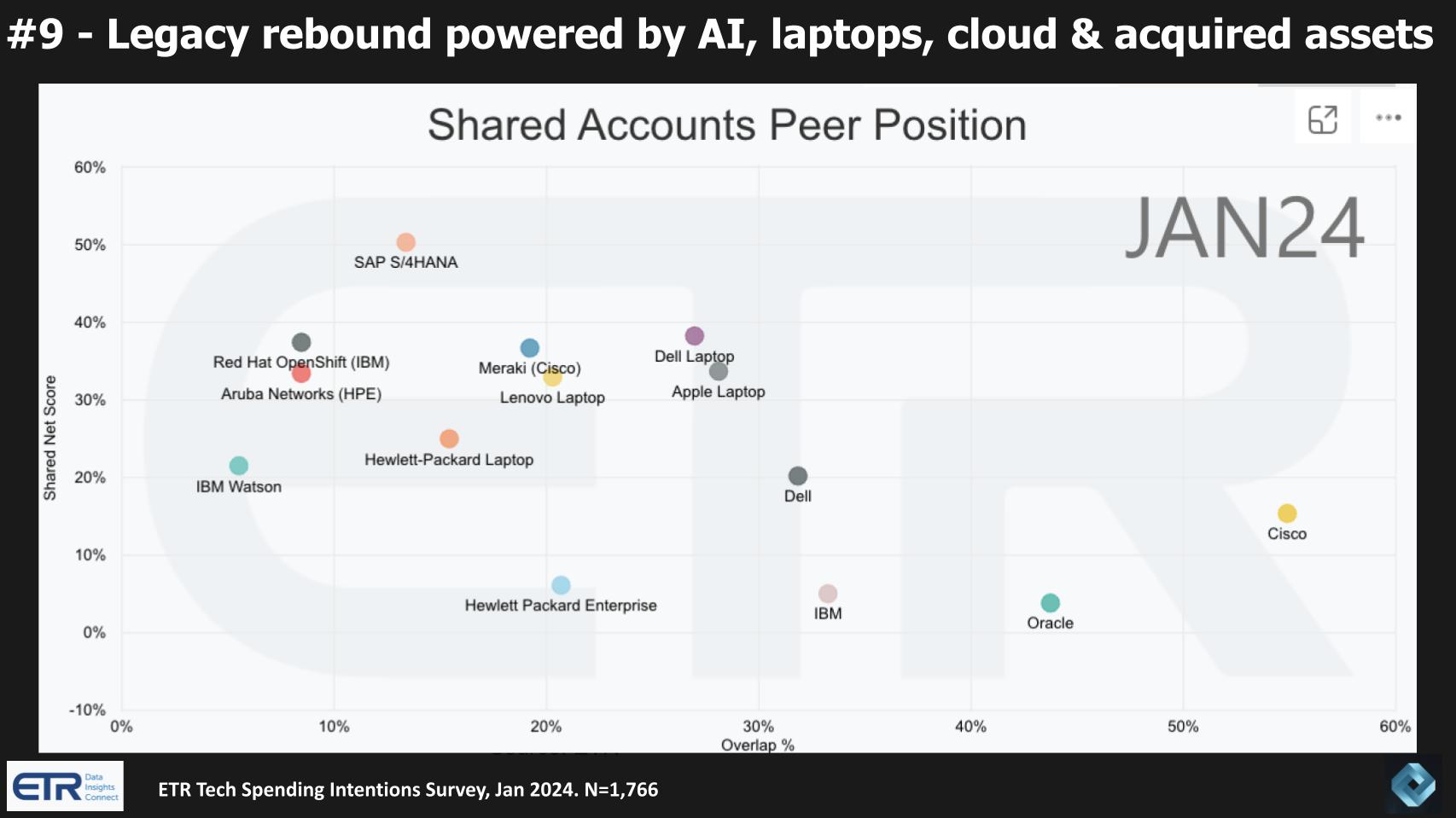

We’re seeing a resurgence of legacy tech companies, powered by a refresh cycle that will support on-prem AI workloads. As well, cloud advancements and strategic acquisitions have enabled these companies to provide “good enough” operating experiences that have stopped the massive bleeding off of workloads to the public cloud. This trend, as reflected in recent data, suggests several key developments that we’ll highlight below. Notably, not all companies are in a position to take advantage of these trends and we believe the leaders in key sectors will benefit to a greater degree.

The following key points are relevant:

In summary, our analysis suggests that legacy companies are experiencing a significant comeback, fueled by AI, cloud innovations and a focus on hardware. This resurgence is not merely a return to form but an evolution, with these companies actively embracing new technologies and market dynamics. As a result, they are well-positioned to compete in the current technology landscape, making them better positioned this decade to compete with the dominance of cloud-native players.

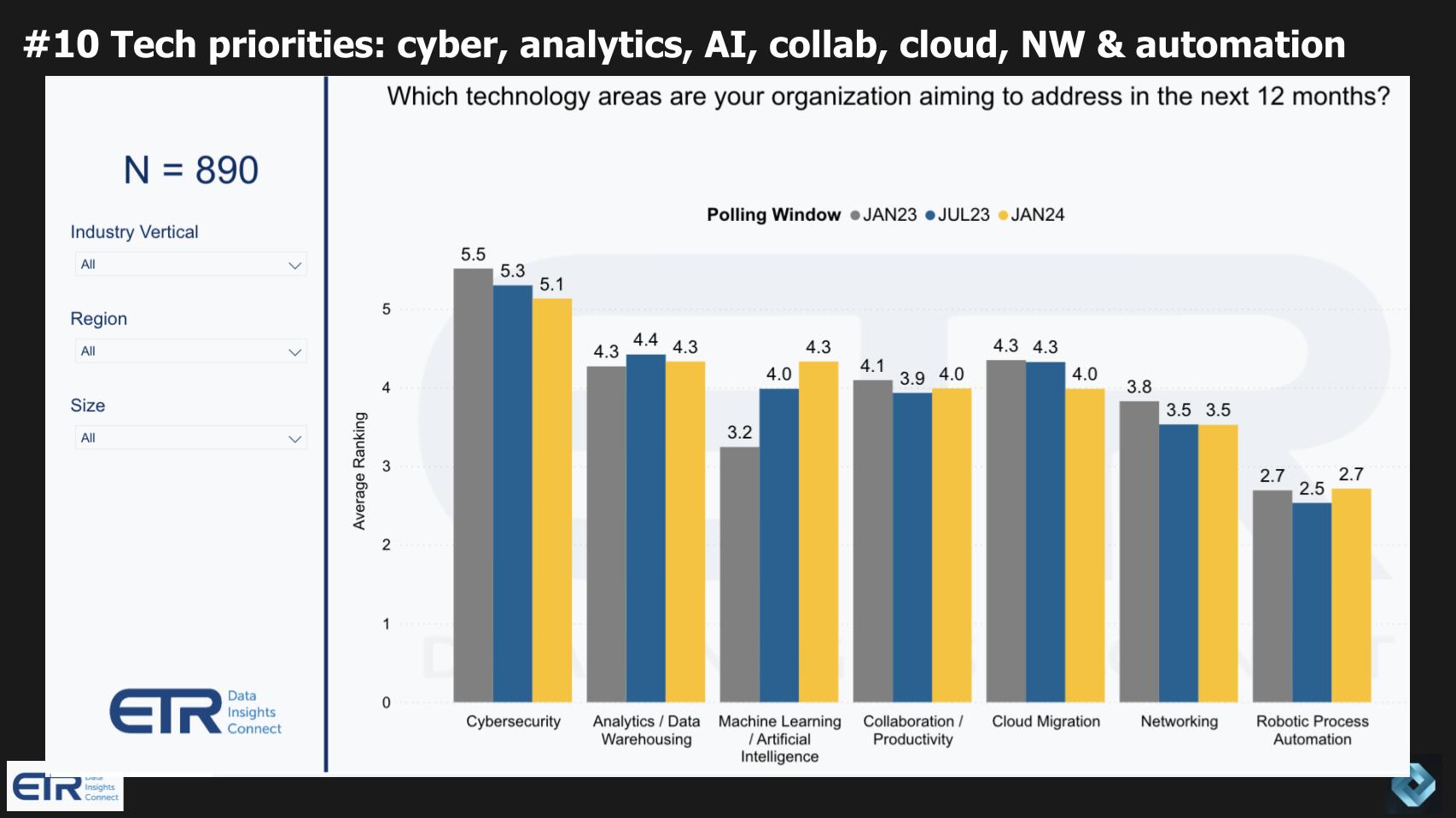

This recent analysis shown below of technology priorities highlights that cybersecurity, analytics, AI, collaboration, cloud, networking and automation remain at the forefront of tech investment and innovation.

Key observations from the data and our predictions include:

In summary, our prediction suggests that cybersecurity, analytics, AI and cloud will remain top tech priorities. However, the nature of cloud adoption is evolving. The focus is shifting from mere migration — lift and shift — to innovation and new workload creation in the cloud, influenced significantly by developments in generative AI. This trend signals a maturing market where established technologies are being leveraged for new, innovative applications.

How do you see 2024 shaping up?

What’s your outlook for tech spending and which technologies will provide the greatest opportunities and disruptive threats?

Let us know.

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on theCUBE Research and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from theCUBE Research and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai or research@siliconangle.com.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

THANK YOU