CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

The past 24 months have seen cloud spending face dual headwinds of macroeconomics and the ability to dial down resources as needed – that is, cloud optimization.

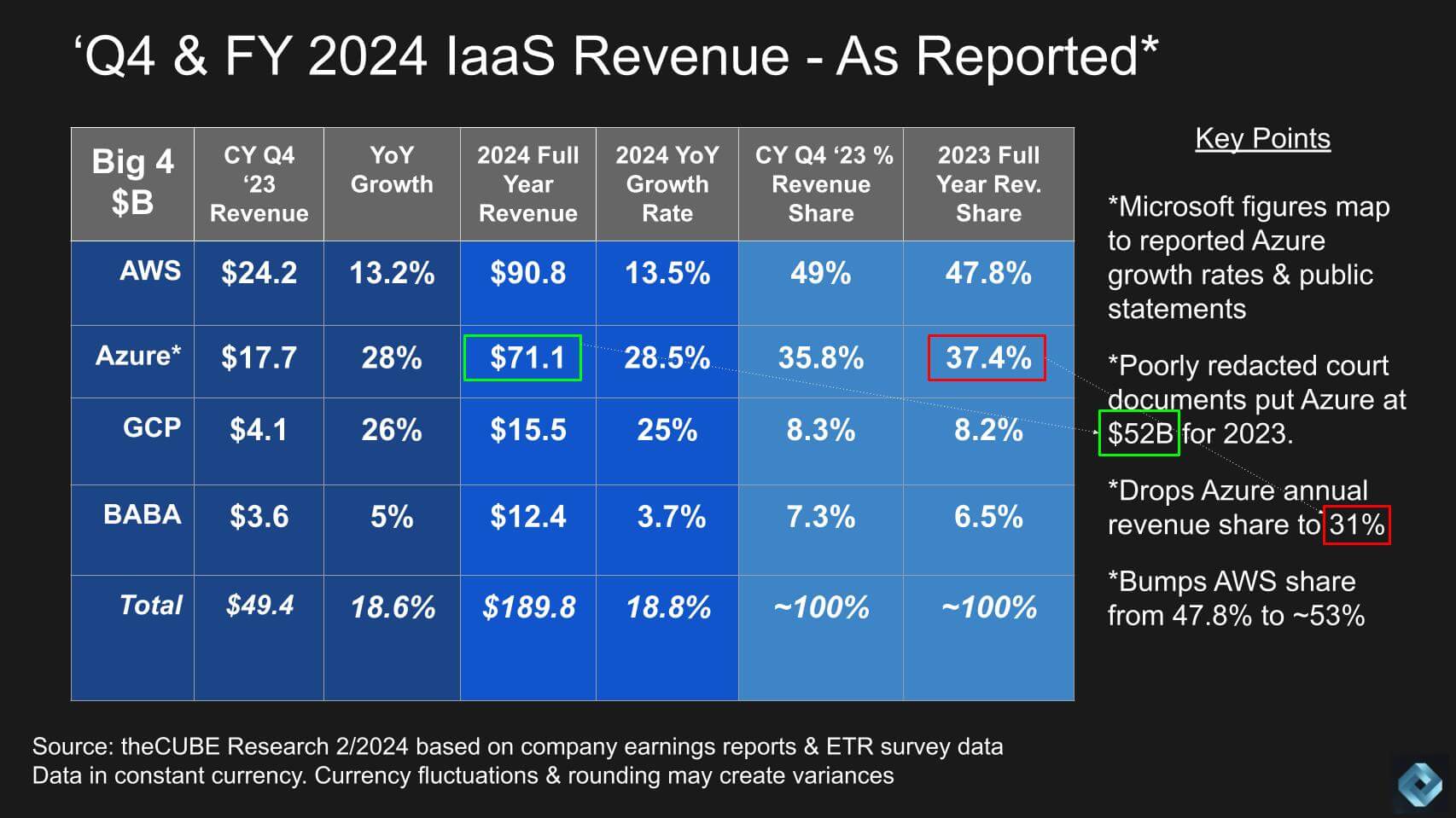

Nonetheless, the big four hyperscaler cloud providers clocked in between $170 billion and $190 billion in infrastructure-as-a-service and platform-as-a-service revenue last year depending on how you factor the leaked court documents, suggesting Azure is much smaller than previously believed. Regardless, hyperscaler growth continued to outpace almost all markets, accelerating between 18% and 19% in revenue terms last year, despite their enormous size.

As we progress into 2024, information technology decision makers are cautiously optimistic about spending levels, especially for the second half. All hyperscalers report that cloud optimization is slowing although pockets of cloud cost cutting remain. While artificial intelligence gets all the headlines, its contribution to revenue is still a small fraction of the overall spending pie. For example, we estimate that Microsoft’s AI services accounted for around $800 million this past quarter.

But the trajectory for AI services and the potential uplift looks promising for all four hyperscalers. We think collectively the generative AI uplift in cloud will surpass $10 billioin this year.

In this Breaking Analysis, we update you on our latest hyperscale cloud spending and market share data. We’ll analyze the Enterprise Technology Research survey data on cloud optimization, assess the generative AI updraft for the big three U.S. cloud players and look at some of the industry trend data on cloud spend by platform.

First let’s review the macro spending climate, which is looking positive but still uncertain.

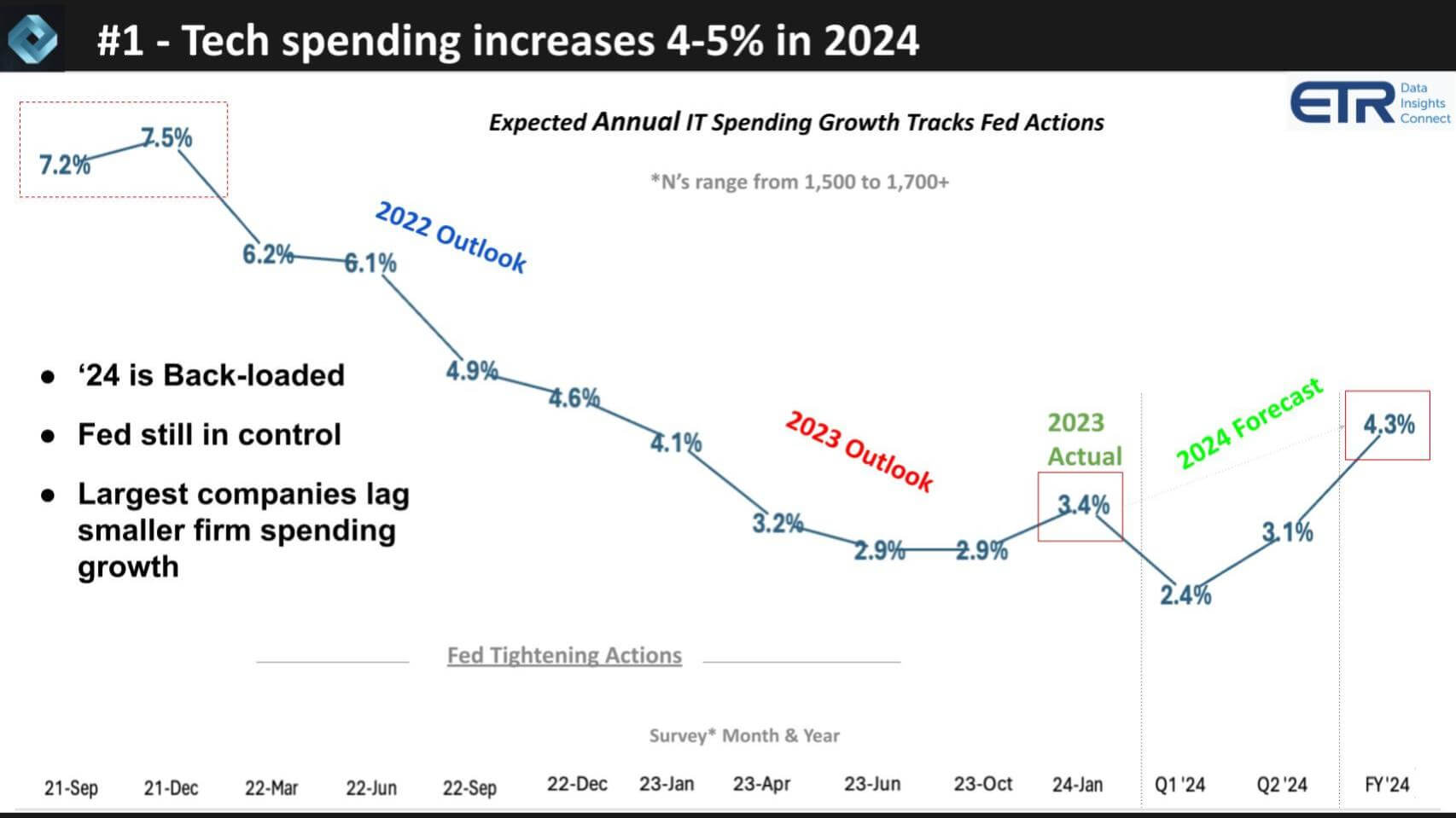

The inflation data came in this past week hotter than expected and sent the stock market reeling. The interest rate-sensitive Nasdaq continues to try to climb out of Tuesday’s lows but ended the week on a down note. The above chart is from our 2024 predictions post shows just how tied spending expectations are to the economic data.

As you can see back in late 2021, information technology decision makers were expecting a whopping 7.5% spending increase for the year. Those annual spend expectations continued to contract as the Fed tightened; and forecasts bottomed at 2.9% in the October survey. And the numbers came in at 3.4% for the year 2023, above expectations in October.

The other good news is that ITDMs expect 2024 to come in at around 4.3% growth. But the caution is it’s very much back-loaded with Q1 and Q2 spending expected to increase 2.4% and 3.1%, respectively. And we think the reality is companies are staying cautious because they don’t know precisely what’s going to happen. Uncertain visibility remains the case for most chief financial officers, hence the back-loaded expectations.

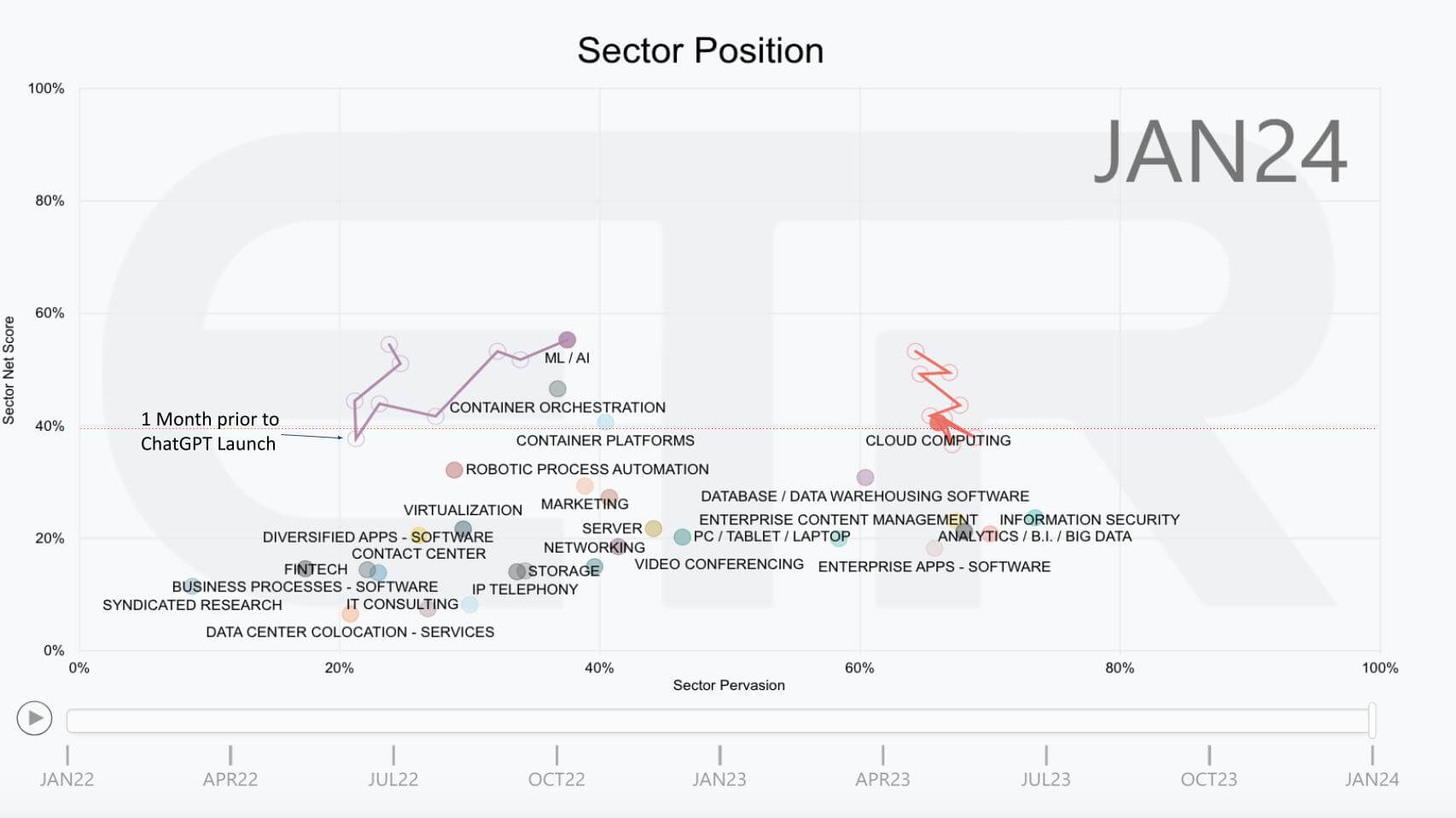

The sector spending patterns indicate that AI is stealing from other sectors. This chart shows the distribution of responses from more than 1,700 ITDMs in the latest ETR spending survey. The data on the vertical axis represents Net Score or spending momentum and the horizontal axis represents perversion of a sector in the data set which is a proxy for relative account penetration for each sector. The red line at 40% indicates a highly elevated spending level.

Focusing on cloud computing, we saw a steady deceleration in cloud spending momentum relative to January 2022, when cloud computing was well above the 40% mark. That deceleration trend reversed in the latest survey, bringing the sector back above the 40% line. This is consistent with what we saw in the revenue data, which we’ll review in a moment.

The other key takeaway from the data is AI has gained notable momentum on both dimensions since the announcement of ChatGPT. Survey data indicates that approximately 40% of new AI projects are being funded by taking funds from other budgets. Most sectors have seen contracting Net Scores on the vertical axis over the past several quarters and AI is the clear exception.

So where are we today and what is the impact of cloud optimization going forward?

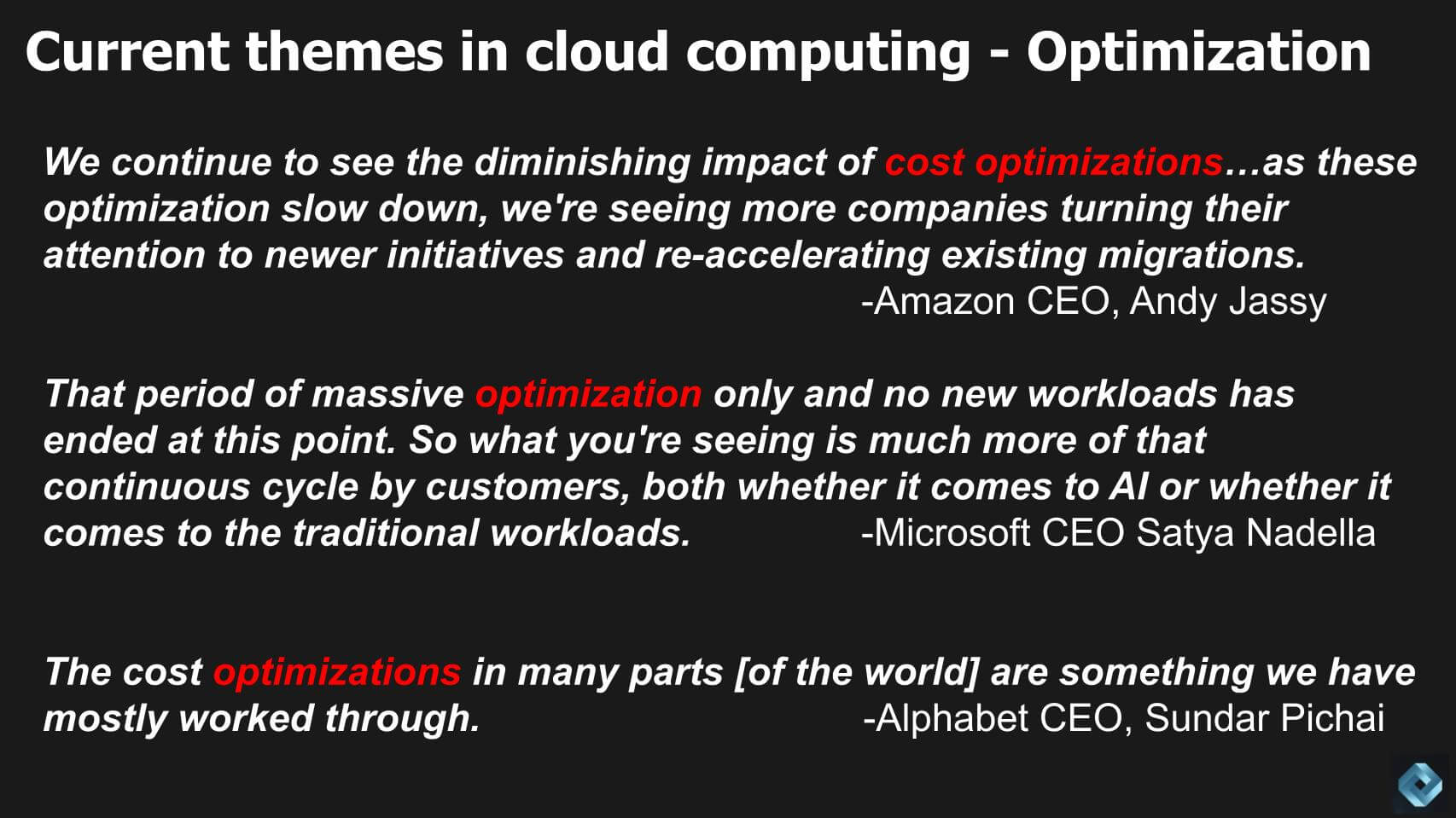

Here are comments from the leaders of the big three U.S. cloud vendors:

We continue to see the diminishing impact of cost optimizations…. As these optimizations slow down, we’re seeing more companies turning their attention to newer initiatives and re-accelerating existing migrations. – Amazon CEO Andy Jassy

That period of massive optimization only and no new workloads has ended at this point. So what you’re seeing is much more of that continuous cycle by customers, both whether it comes to AI or whether it comes to the traditional workloads. – Microsoft CEO Satya Nadella

The cost optimizations in many parts [of the world] are something we have mostly worked through. – Alphabet CEO Sundar Pichai

Let’s look at what the survey data says about cloud optimization.

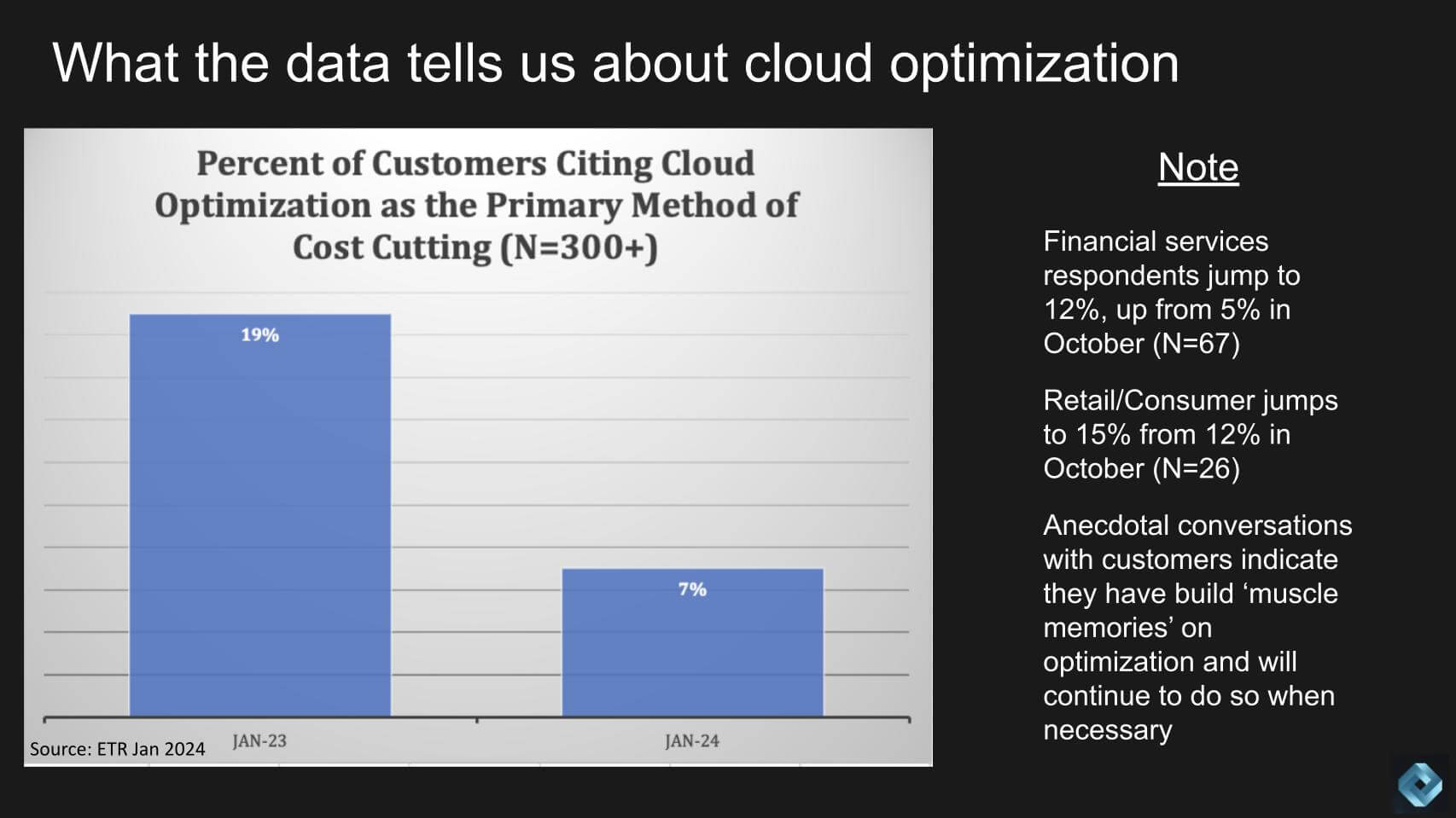

The chart above shows the percentage of customers indicating that cloud optimization is the primary cost-cutting method. This figure has reduced dramatically from one year ago to 7% down from 19% of customers. However, in the important financial services sector, we continue to see customers citing cloud optimization as a primary method (12%). That’s up from 5% in the October survey. Fifteen percent of retail customers say it’s their primary method, but that could be related to winding down holiday capacity increases.

The caution is further underscored by the anecdotal comment shown above which says that customers became adept at dialing down capacity and optimizing cloud spend. They’ve developed “muscle memory” and while they’re turning more attention to innovation, optimization is still an important tool in the kit.

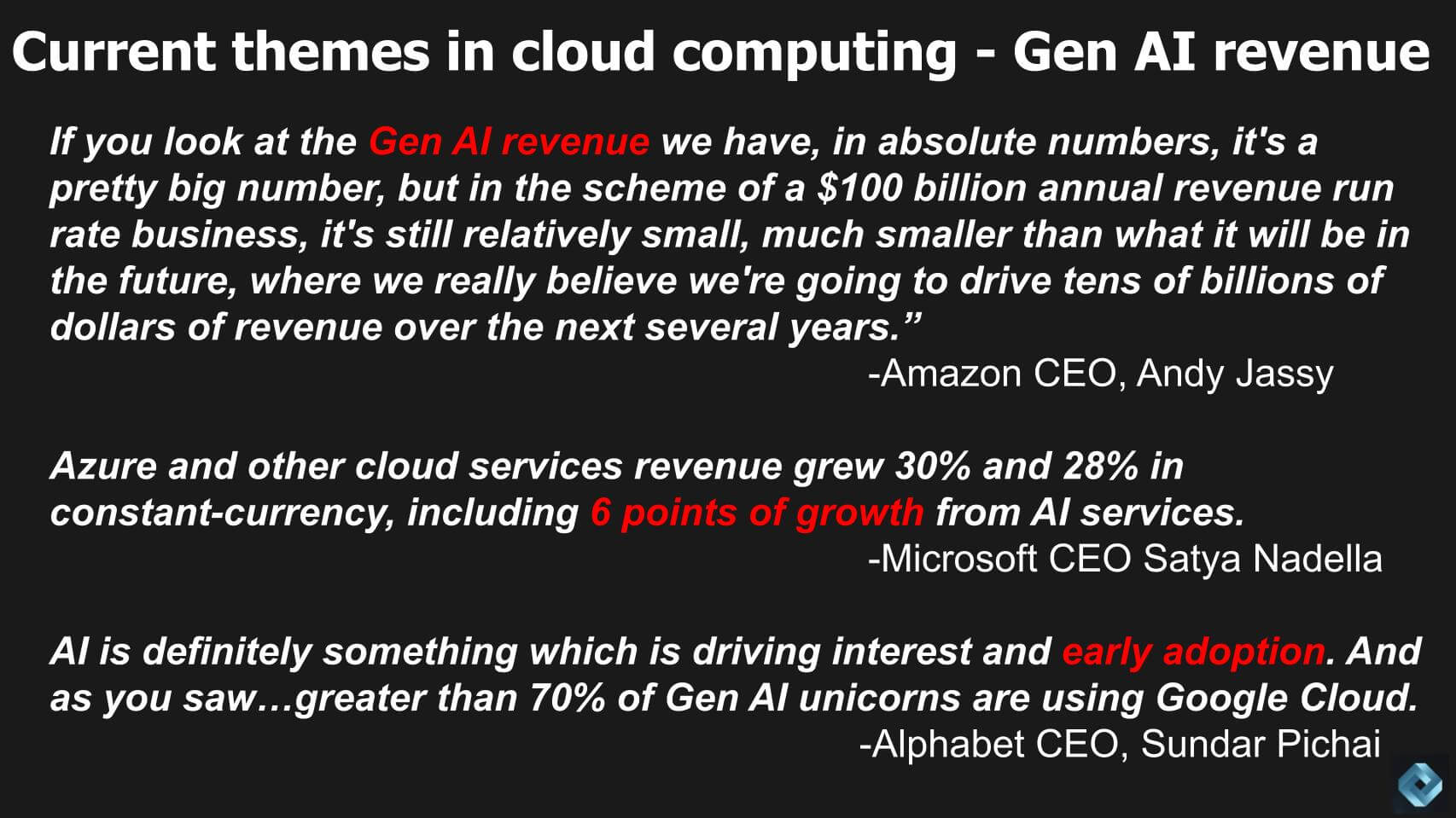

Of course the other big theme we listen for in earnings calls is generative AI revenue.

Here are some comments from the big three worth reviewing:

If you look at the gen AI revenue we have, in absolute numbers, it’s a pretty big number, but in the scheme of a $100 billion annual revenue run rate business, it’s still relatively small, much smaller than what it will be in the future, where we really believe we’re going to drive tens of billions of dollars of revenue over the next several years.” – Amazon CEO Andy Jassy

Azure and other cloud services revenue grew 30% and 28% in constant-currency, including six points of growth from AI services. – Microsoft CEO Satya Nadella

AI is definitely something which is driving interest and early adoption. And as you saw… greater than 70% of gen AI unicorns are using Google Cloud. – Alphabet CEO Sundar Pichai

Let’s look at the market data.

Above we show data for the big four hyperscalers both quarterly and full year. For the fourth calendar quarter, these companies generated nearly $50 billion in revenue. Amazon Web Services and Google Cloud Platform growth accelerated in the quarter and Azure was flat.

Other key trends:

Nuanced, we know, but we continue to dig into this issue to get to the bottom of the story.

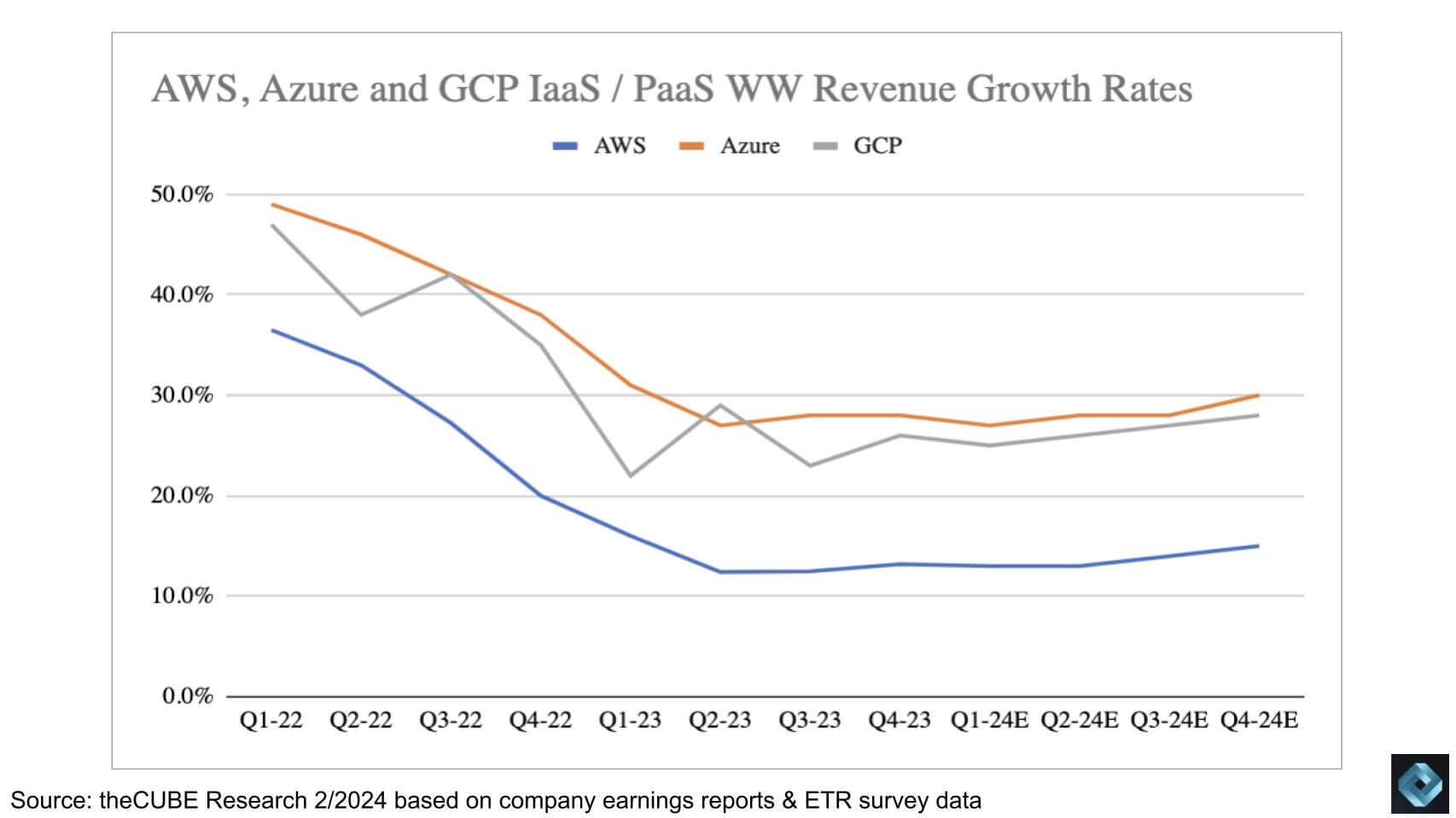

Below is a graphic of the growth rates for the big three U.S. hyperscalers:

AWS is the bottom line in blue, GCP is the gray and Azure is the orange. Note AWS reversed the decelerating growth rate trend and actually grew sequentially to 13.2% from 12.5% last quarter. That, for a $100 billion run rate company, is quite a feat. Azure was flat despite the six points of tailwind from AI, and GCP grew by our estimates. But for its size and maturity, Google Cloud should be growing much faster, in our view. That’s the penalty you pay for being No. 3.

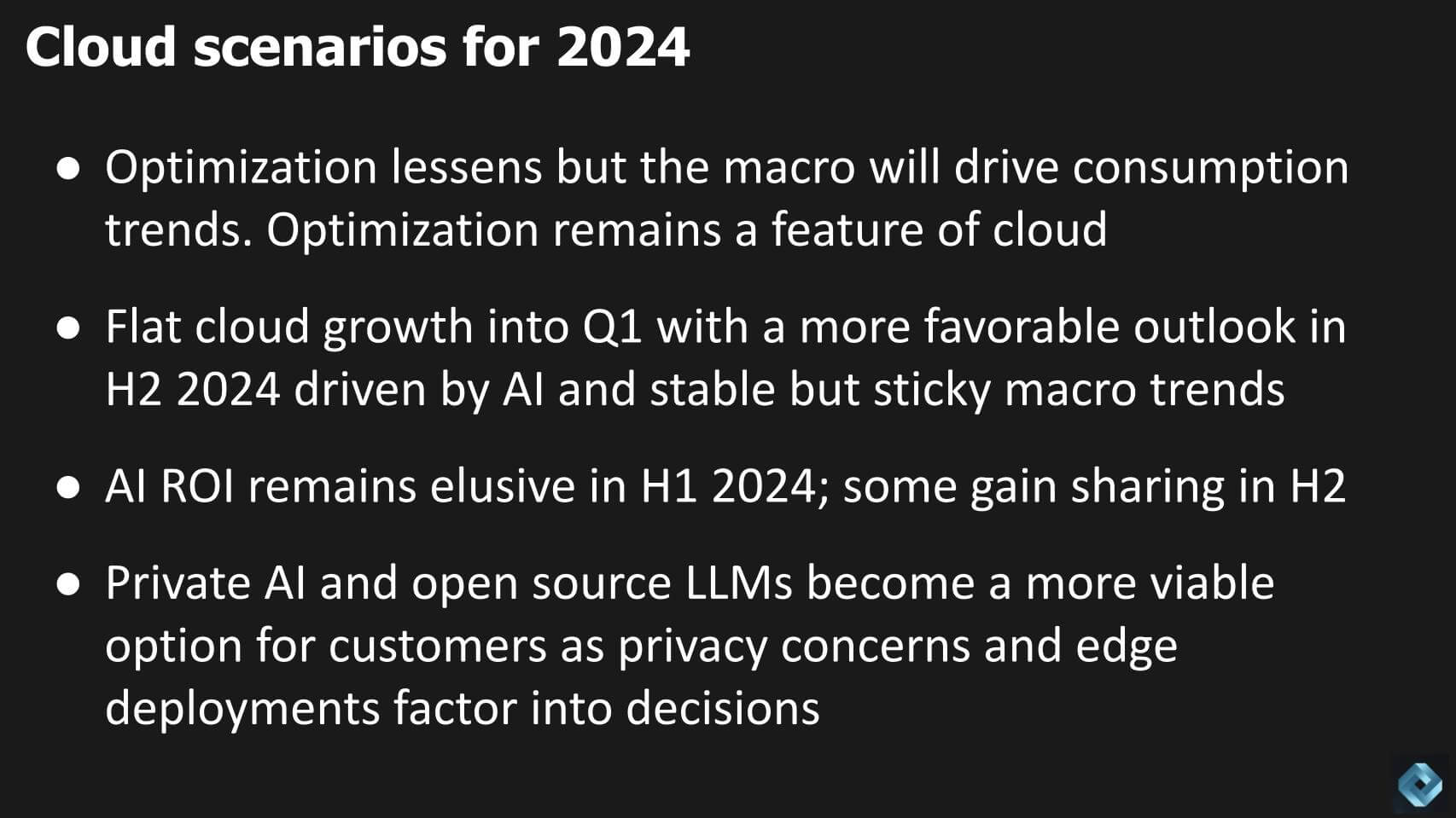

Our working assumptions for 2024 basically follow the macro trends with growth holding and maybe softening a bit in the first half and picking up in the second half, bolstered by an ever-accelerating contribution from AI.

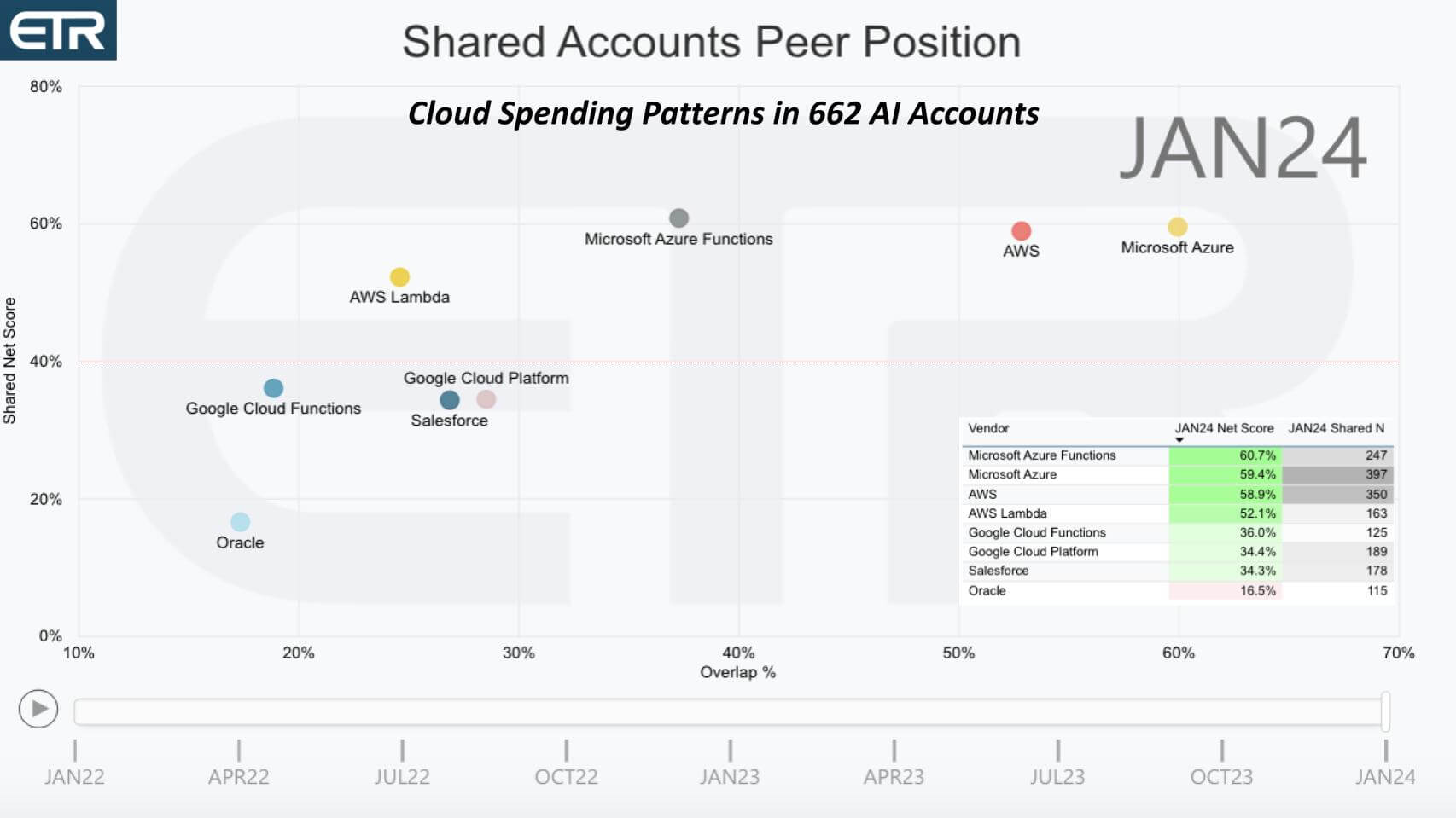

Speaking of AI, let’s look at the spending patterns in 662 AI accounts from the ETR data. What we’re doing here is filtering the 1,700-plus respondents on AI accounts and identifying the spending momentum and presence of each cloud platform in the data.

The chart above shows Net Score or spending velocity on the vertical axis and penetration within the 662 AI accounts for each platform on the horizontal axis. The table insert shows how the data are plotted on the graphic. The key points are:

Note: We filtered this data on platforms with N at or greater than 100 so it doesn’t show, for example, IBM cloud or the on-prem/hybrid players.

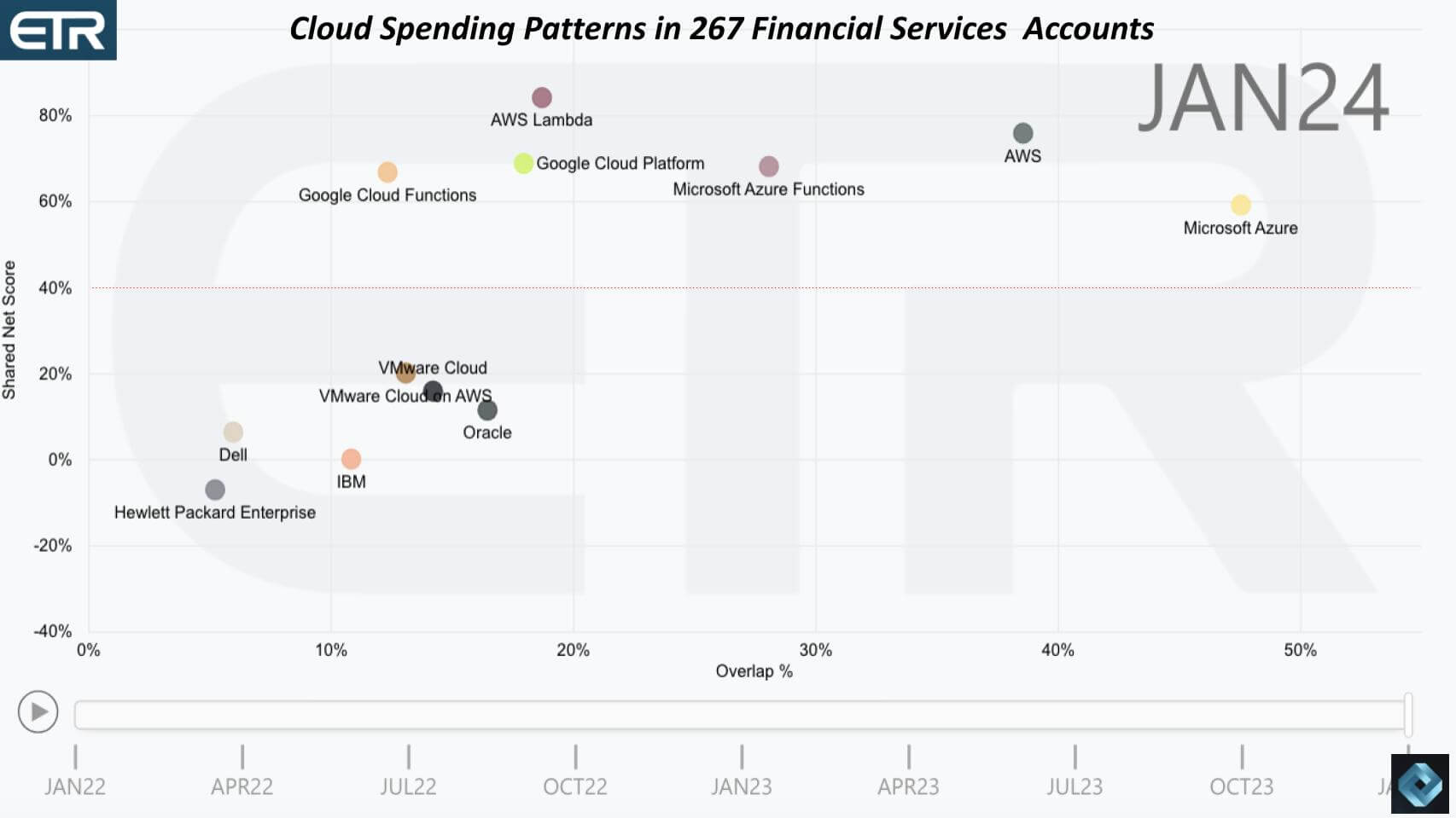

This next chart filters the data on 267 financial services accounts in the data set.

The key points that stand out are:

The adoption of cloud in financial services is quite notable given the early cloud backlash from the financial industry. Look how far above the 40% line all the U.S. hyperscalers sit.

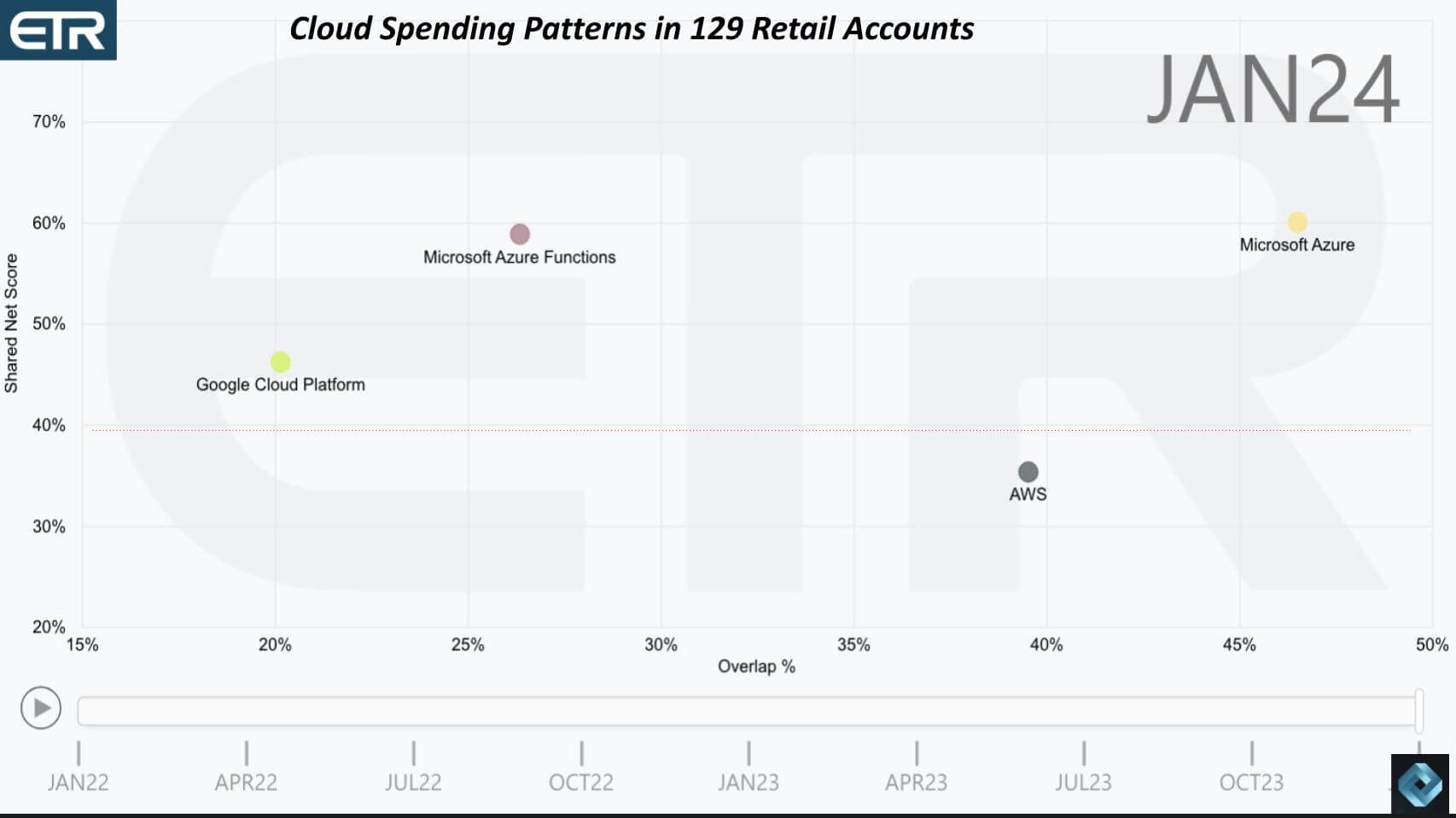

The last vertical we’ll dig into is retail, which shows a far different picture, especially for AWS with retail rivals such as Walmart leveraging other clouds.

Both Azure and GCP show higher Net Scores than AWS in this picture, but AWS still has a big presence in the sector. But it’s below the 40% mark, while the other two are above.

So that’s a quick run-through of the latest data. There’s so much more that we’re discussing with our private clients, but if you have specific questions, let us know and we’ll try to help.

Let’s wrap with some final thoughts.

Open-source models such as Llama could really commoditize the big language models, so the key is how the developers of such models deploy them. Microsoft’s success with GitHub Copilots could be repeated with productivity software, but early reports are that using copilots for Powerpoint and Excel is still clunky. And Google has a lot to lose with 10 blue links on every page with its auction model optimizing revenue.

That’s perhaps not as relevant to the cloud, but it’s an example where AWS and Microsoft don’t have to worry about protecting a golden search goose. In fact, Amazon Rufus is really intriguing because if it’s effective, I won’t have to go to Google to research a purchase as much.

The market is really uncertain right now in the short term. Longer-term the picture is bright and like most of these waves is will likely exceed expectations.

In the near term expect some disappointments along the way.

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on theCUBE Research and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from theCUBE Research and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai or research@siliconangle.com.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

THANK YOU