Materials

Industries

Providing a wide range of applications and solutions for various industries.

Industries

Automotive

Automotive grade certified precision parts.

Industrial machinery

Multiple material choices make industrial parts more competitive.

Medical and Dental

Medical grade certified precision parts.

Aerospace & Aviation

Precision manufacturing boosts aerospace development.

Consumer electronics

First choice for new product launches.

Robotics

Accelerate the development of the future robotics industry.

3D Printing Industries

3D Printing for Automotive

Transform processes and enable customized and innovative automotive parts.

3D Printing for Medical and Dental

Personalized healthcare solutions and

specific treatments.

3D Printing for Cultural Creativity

Promote the innovation and development of

cultural and creative industries

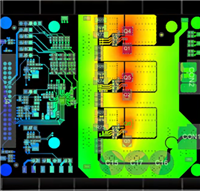

3D Printing for Industrial

Driving progress and innovation in

manufacturing